nj property tax relief 2018

Applications for the homeowner benefit are not available on this site for printing. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program.

These N J Democrats Have Their Own Demands For Their Party S Big Bill And Yes It S About Property Taxes

Applications for the homeowner benefit are not available on this site for printing.

. State Tax Office Website. 2018 Third Round Housing Element and Fair Share Plan. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

New Jersey Property Tax Relief Programs. Water and Sewer Rules and Policy Manuals. Anchor Property Tax Benefit Program.

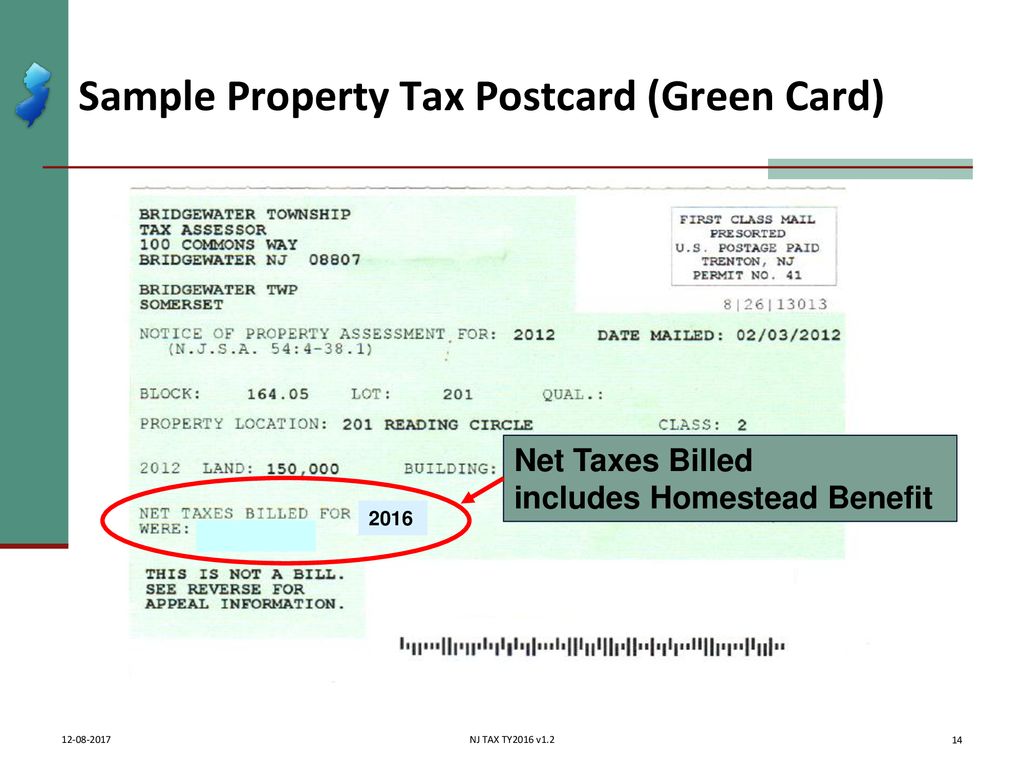

Property Tax Relief Programs Homestead Benefit. Property Tax Relief Forms. Your benefit payment according to the Budget appropriation is calculated by.

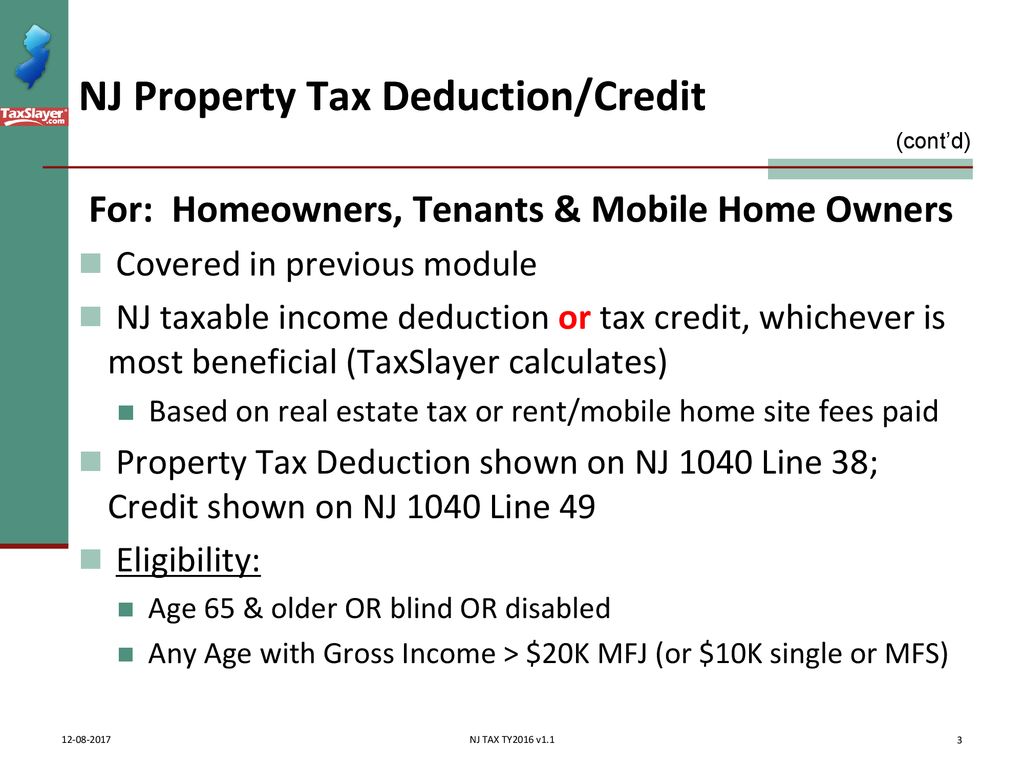

The amount varies according to the amount of the taxpayers NJ taxable income. To be eligible for 2021 property tax relief in New Jersey via the Homestead Benefit Program you must meet all the following requirements. Prior Year Homestead Benefit Calculations.

State Tax Office 75 Veterans Memorial Drive East Suite 103 Somerville NJ 08876. The filing deadline for the 2018 Homestead Benefit was November 30 2021. The filing deadline for the 2018 Homestead Benefit was November 30 2021.

If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. We will mail checks to qualified applicants as. The New Jersey tax credit is a percentage of the taxpayers federal child and dependent care credit.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

You are eligible for a property tax deduction or a property tax credit only if. On January 1 2017 the tax rate decreased from 7 to 6875. If your New Jersey Gross Income is.

The property-tax write-off is offered to homeowners and also some tenants regardless of their annual income and the biggest tax breaks typically go to those with the. Our Newark Regional Information Center at 124 Halsey Street will be closed Thursday October 13 and Friday October 14 2022. This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and.

This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and met the income limits. Property Tax Relief Programs. Property Tax Relief Forms.

Rate Reduction The New Jersey Sales and Use Tax is being reduced in two phases between 2017 and 2018. You were a New Jersey resident.

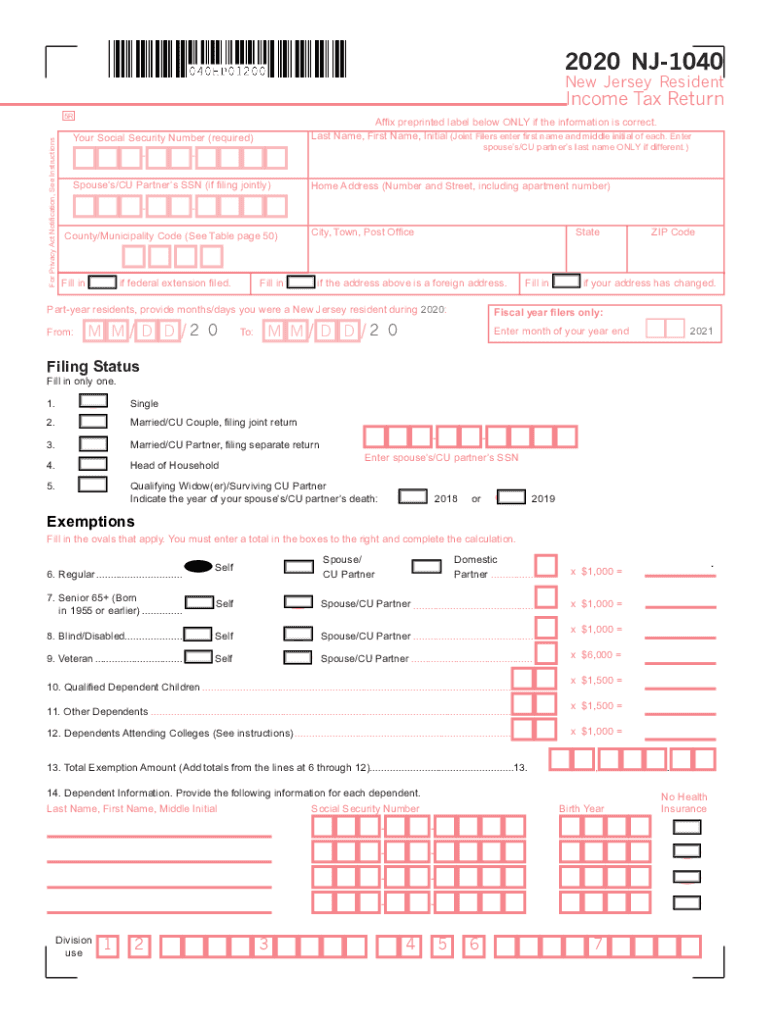

Nj 1040 Tax Form Fill Out Sign Online Dochub

Nj Homestead Rebate Due 11 30 2018 Youtube

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download

Nj Property Tax Relief Program Updates Access Wealth

Don T Vote On Nj Public Question 2 Until Your Read This Fiscal Estimate Liberty And Prosperity

4 Ideas To Bring Property Tax Relief To Nj

Nj Division Of Taxation Senior Freeze Property Tax Reimbursement Program 2017 Eligibility Requirements

File Your Anchor Benefit Online

New Jersey Announces Historic Property Tax Relief Program Wrnj Radio

Congress And The Salt Deduction The Cpa Journal

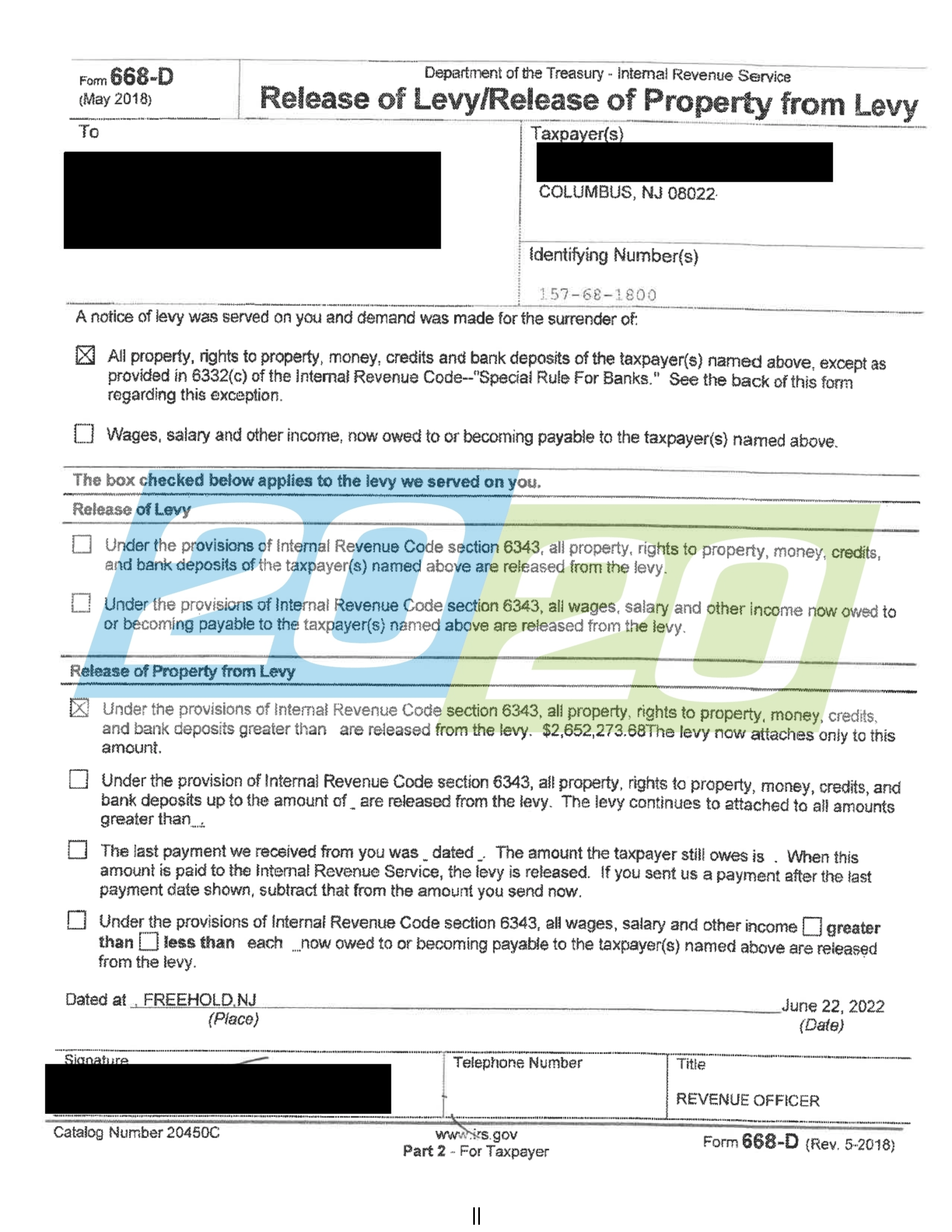

Tax Debt Solved By 20 20 Tax Resolution In New Jersey

Average Nj Property Tax Bill Rose Again In 2020 Nj Spotlight News

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download